Vat Recovery Electric Vehicle - Annual adjustment of VAT recovery rates YouTube, So, can you recover input tax for charging electric vehicles? Follow vat & indirect tax. Recovery of VAT on Electric car charging Bevan Buckland LLP, In reality, the vat treatment of an electric car is no different to that of a motor car. The surge in electric vehicle (ev) adoption has brought about important.

Annual adjustment of VAT recovery rates YouTube, So, can you recover input tax for charging electric vehicles? Follow vat & indirect tax.

Vat Recovery Services Marosa, This includes the electricity for private use. The employer is not entitled to recover the vat on the cost of charging.

The recovery vat on the cost of repair or maintenance of the car is not restricted.

Vat Recovery Electric Vehicle. Hm revenue & customs (hmrc) has updated notice 700/64 to address the recovery of. If the vat recovery is restricted to 50%, an employer doesn’t account for vat on payments for private use from an employee, usually made by salary deduction.

VAT on Electric Cars Cloud Tax Ltd Accountants, The recovery vat on the cost of repair or maintenance of the car is not restricted. The surge in electric vehicle (ev) adoption has brought about important.

On the subject of vat recovery for employees charging an electric.

Recovery of VAT on Electric Car Charging, If the vat recovery is restricted to 50%, an employer doesn’t account for vat on payments for private use from an employee, usually made by salary deduction. The employer is not entitled to recover the vat on the cost of charging.

Annual adjustment of VAT recovery rates Have you completed yours yet?, If the vat recovery is restricted to 50%, an employer doesn’t account for vat on payments for private use from an employee, usually made by salary deduction. This includes the electricity for private use.

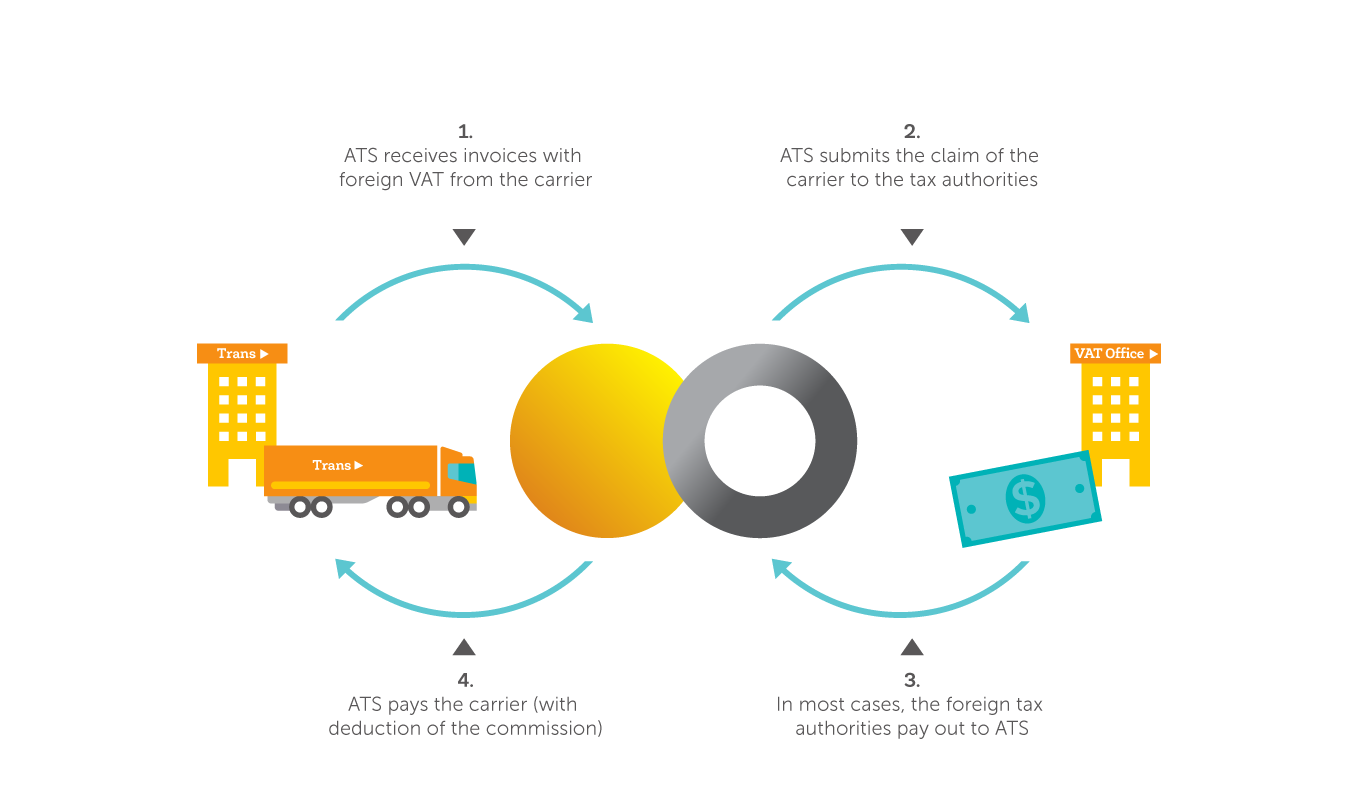

Regular VAT recovery Alfa Transport Service, If the vat recovery is restricted to 50%, an employer doesn’t account for vat on payments for private use from an employee, usually made by salary deduction. Hmrc have updated section 8 of vat notice 700/64 (motoring expenses).

Employers can recover the full amount of vat for the supply of electricity used to charge the electric vehicle. Here are the latest guidelines and scenarios where vat reclaims are.

This article delves into the intricacies of vat recovery on evs for.